Best Budgeting Apps for Financial Independence in 2025

Achieving financial independence (FI) is a noble and empowering goal, but reaching it requires discipline, smart planning, and consistent tracking of your finances. One of the best tools to help you stay on track is a budgeting app. In 2025, there are several great options that can help you manage your money, save for future goals, and monitor your financial progress. Here’s a look at some of the best budgeting apps to help you on your journey to financial independence, complete with pros and cons for each one.

1. Mint – The All-in-One Budgeting App

Best for: Beginners or anyone looking for an easy-to-use, free app to track expenses and set financial goals.

Mint has been a household name for years, and for good reason. It automatically syncs with your bank accounts, credit cards, loans, and even investment accounts, giving you a complete overview of your financial life. It categorizes transactions, helps you create budgets, and even tracks your credit score.

Pros:

- Free to use with no hidden fees

- Automatic transaction categorization

- Easy-to-use interface

- Credit score monitoring

- Bill reminders to help you avoid late payments

Cons:

- Limited customization options for categories

- Occasionally inaccurate transaction categorization

- Ads for financial products can be intrusive

- Limited investment tracking features

Why It’s Great for Financial Independence: Mint makes tracking your expenses and saving for FI simple. Its goal-setting feature helps you visualize and track milestones, like saving a specific percentage of your income or reaching a certain net worth.

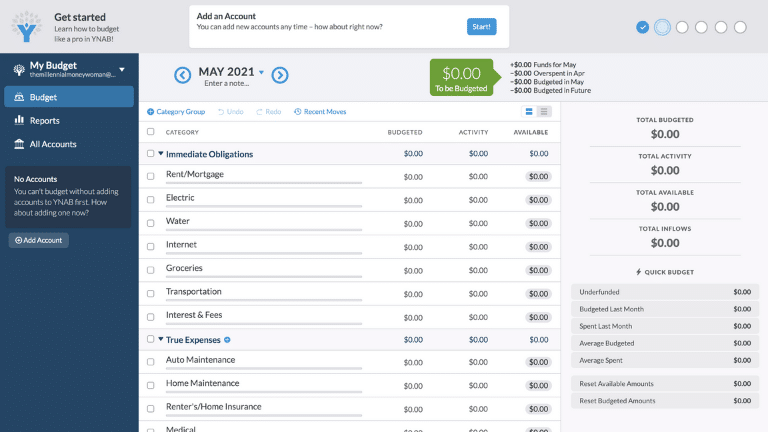

2. YNAB (You Need A Budget) – Take Control of Every Dollar

Best for: People who want to take a proactive, hands-on approach to budgeting and are willing to invest in their financial education.

YNAB is a zero-based budgeting app, which means that every dollar you earn is assigned a specific task—whether it’s going toward bills, savings, or discretionary spending. This hands-on method requires more effort but results in a clearer financial picture.

Pros:

- Helps you live on last month’s income

- Strong focus on goal setting and financial education

- Real-time tracking of your spending

- Provides helpful budgeting tutorials and resources

Cons:

- Subscription required (after 34-day free trial)

- Steeper learning curve for beginners

- Limited investment tracking

- No automatic syncing with some financial institutions

Why It’s Great for Financial Independence: YNAB encourages you to be intentional with every dollar, which helps build a strong savings habit. Its goal-setting features make it easy to track your progress toward your FI targets, especially if you’re trying to aggressively pay off debt or increase your savings rate.

3. GoodBudget – Envelope Budgeting for the Digital Age

Best for: Those who prefer a traditional envelope budgeting system but want to go digital.

GoodBudget lets you create virtual envelopes to allocate funds for various spending categories (e.g., groceries, entertainment, bills). When the envelope is empty, you stop spending in that category. It’s a simple, straightforward budgeting method.

Pros:

- Simple envelope budgeting method

- Syncs across multiple devices

- Customizable categories for different goals

- Available on both iOS and Android

- Free version available with core features

Cons:

- No automatic transaction import (you have to manually enter expenses)

- Limited features in the free version

- Doesn’t integrate with bank accounts or credit cards

- Limited investment tracking

Why It’s Great for Financial Independence: The envelope system encourages controlled spending, making it easier to prioritize saving for financial independence. It’s a simple and no-frills app for people who want to keep their finances organized and goal-oriented.

4. PocketGuard – The “How Much Can I Spend?” App

Best for: People who want a minimalist approach to budgeting and need help controlling their daily spending.

PocketGuard automatically categorizes your transactions, and then it tells you how much “available” money you have to spend without affecting your financial goals. It’s designed to answer the question, “How much can I spend today?”

Pros:

- Easy-to-use, minimalist interface

- Tracks discretionary spending (what’s available to spend)

- Bill tracking and reminders

- Syncs with most major financial institutions

- Free version available

Cons:

- Limited budgeting features in the free version

- No investment tracking

- Some users report occasional syncing issues

- Can be a bit simplistic for users with more complex budgeting needs

Why It’s Great for Financial Independence: By focusing on your available funds, PocketGuard helps prevent overspending, allowing you to put more money toward your savings or FI goals. Its simple structure is perfect for those who want to keep their finances uncomplicated and easy to manage.

5. EveryDollar – Budgeting Made Simple

Best for: Fans of Dave Ramsey’s “Baby Steps” system or those who want a clean, easy-to-use app for zero-based budgeting.

EveryDollar follows the zero-based budgeting method, which means that you plan for every dollar you earn. Whether you’re budgeting for expenses, debt repayment, or saving for FI, EveryDollar lets you allocate funds to specific categories. It offers both a free version and a paid version with additional features.

Pros:

- Simple, user-friendly interface

- Follows the zero-based budgeting system

- Debt tracking tools for people following Dave Ramsey’s Baby Steps

- Syncs with bank accounts in the paid version

- Free version is still quite functional

Cons:

- Paid version is subscription-based

- Limited investment tracking

- Lacks some advanced features offered by other apps

- No free transaction importing in the paid version

Why It’s Great for Financial Independence: If you’re following a structured approach to achieving FI, like Dave Ramsey’s Baby Steps, EveryDollar can help you stay focused and track your progress. The zero-based budgeting method is effective for those looking to save aggressively and eliminate debt.

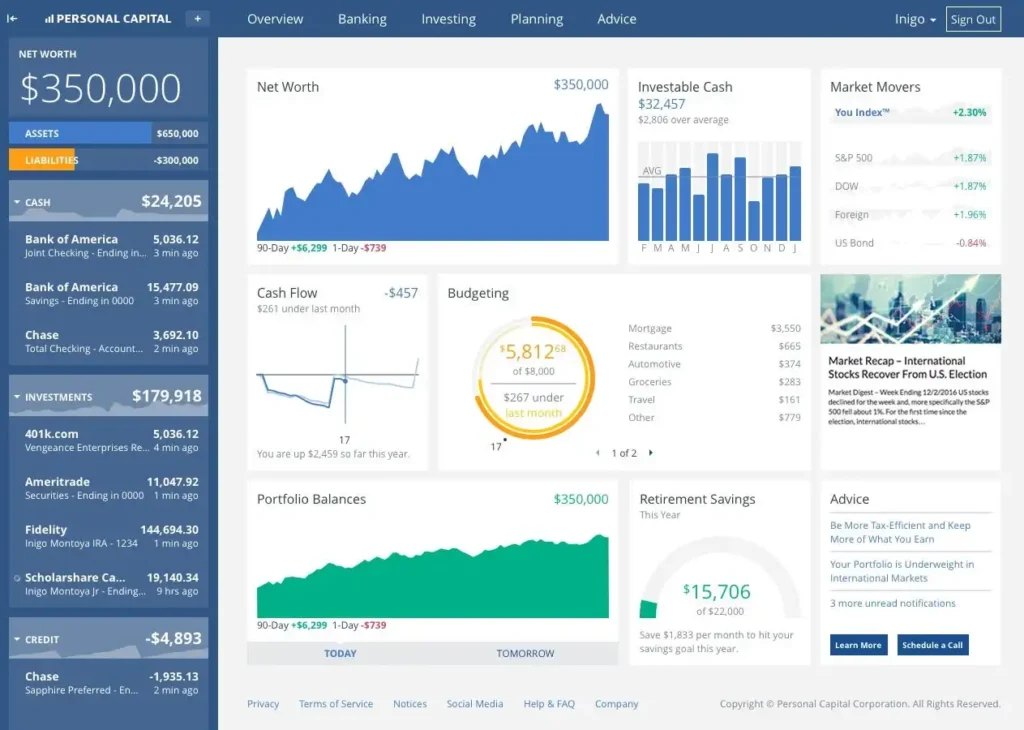

6. Personal Capital – Budgeting with Investment Tracking

Best for: Those who want a comprehensive financial tool that combines budgeting with investment and retirement planning.

Personal Capital isn’t just a budgeting app; it also tracks your investments and retirement accounts. It gives you a snapshot of your spending while offering powerful tools to track your net worth, manage investments, and plan for retirement.

Pros:

- Combines budgeting with investment and retirement tracking

- Tracks your net worth

- Retirement planning tools and calculators

- Free version available with most key features

- Comprehensive reports and graphs for financial analysis

Cons:

- Some features are limited in the free version

- Interface can feel cluttered and overwhelming for new users

- Requires you to link multiple accounts for the most accurate tracking

- No cash envelope system or manual entry for budgeting

Why It’s Great for Financial Independence: Personal Capital is perfect for those who want a holistic view of their financial life, combining budgeting with long-term wealth management. The retirement planner and net worth tracker are especially valuable for anyone planning for early retirement or seeking financial independence.

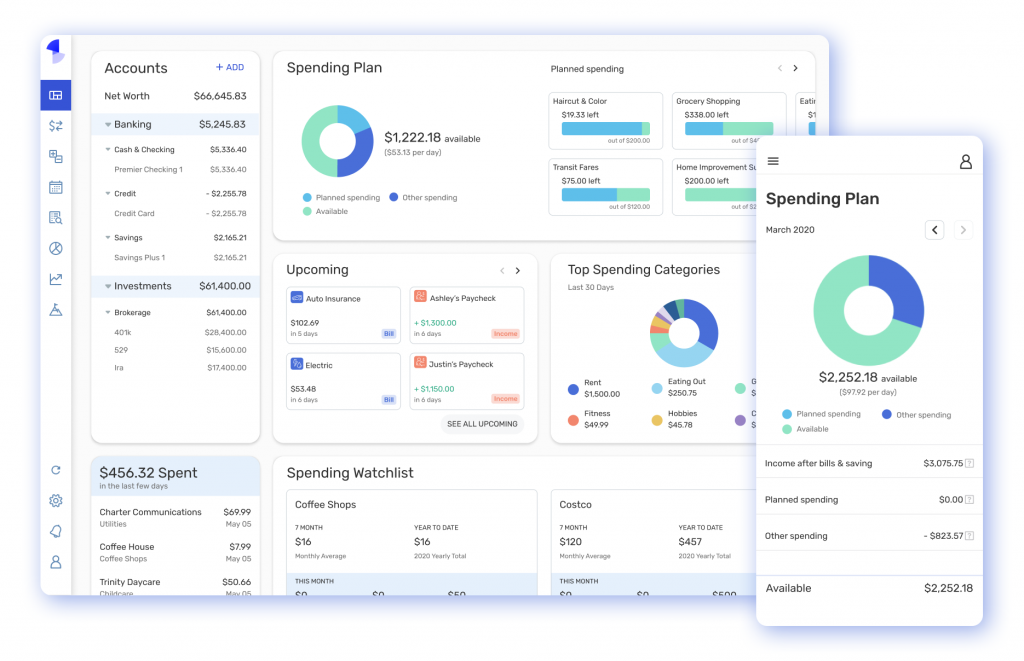

7. Simplifi by Quicken – A Streamlined Way to Budget

Best for: People who want a clean, modern budgeting app with robust customization features.

Simplifi is a newer app from Quicken that’s designed to be simple yet powerful. It gives you real-time tracking of all your accounts and helps you set financial goals, track spending, and optimize savings.

Pros:

- Real-time tracking of your bank accounts and credit cards

- Goal setting with visual progress trackers

- Customizable categories

- Subscription includes advanced features like bill tracking

- Clean, modern interface

Cons:

- Subscription-based (free trial for 30 days)

- Somewhat limited features for investing and long-term planning

- Limited free version

- Can feel basic compared to other comprehensive budgeting apps

Why It’s Great for Financial Independence: Simplifi makes it easy to track and manage your finances with a focus on real-time data and goal setting. It’s a great choice for anyone who wants a simple yet customizable tool to monitor spending and savings toward their FI goals.

Final Thoughts

No matter your financial independence journey, these apps can provide the structure and motivation needed to succeed. The right app for you will depend on your specific needs—whether you’re looking for a simple tracking tool, a system that integrates with your investments, or an app that helps you live on last month’s income. Budgeting is a key part of building wealth, and with the right app, you’ll be better equipped to stay on track and hit your financial goals. Happy budgeting!

You may also want to check our article about : How to Develop Emotional Intelligence for Personal and Professional Growth